property tax in france 2019

Owners are liable for a tax based on the rental value of the property assessed by the tax authorities. DINR PART - March 10 2021.

Taxes In France A Complete Guide For Expats Expatica

To find out more please refer to the International section of the website concerning nonresident individuals.

. Reductions in the corporate tax rate and the tax burden placed on. In each case you will be sent an acknowledgement of receipt for each. France 2020 Income Tax Calculator.

Income Tax Rates and Thresholds Annual Tax Rate. Real property tax - Rental income for residential apartments are taxed at the normal PIT rates after the deduction of all the expenses borne by the landlords. As the table above illustrates this means in simple terms that the maximum personal income tax rate in France in 2019 is 49 45 4.

The VAT is a sales tax that applies to the purchase of most goods and services and must be collected and submitted by the merchant to the France governmental revenue department. Note that the proposed measures dont apply to second home owners in France. This graph presents the total revenue generated by income taxes in France from 2006 to 2019 in million euros.

The current France VAT Value Added Tax is 2000. Wealth tax IFI Even if you are no longer a resident of France for tax purposes you are still liable for weath tax impôt sur la fortune immobilière on your assets located in France. TaxLeak - France Tax Calculator.

Thats why we have created this tool in order to help you estimate your personal income tax burdern in France based on the latest fiscal data from the French authorities for 2019. Country Note France. The planned measures will see an initial 30 reduction in your residential tax bill from November 2018.

This note explains how France taxes energy use. Calculate your net salary in. About 20 tax on a 100 purchase.

Over this period revenue from taxes increased steadily reaching almost 88 billion. Taxing Energy Use 2019. The note shows the distribution of effective energy tax rates the sum of fuel excise taxes explicit carbon taxes and electricity excise taxes net of applicable exemptions rate reductions and refunds across all domestic energy use.

France 2019 Income Tax Calculator. France Non-Residents Income Tax Tables in 2019. You can pay your taxes directly from your personal account via the online payment system not accessible from your personal account or from your tablet or smartphone.

To be eligible your income must not exceed a certain threshold then you will benefit from a reduction of 30 in 2018 65 in 2019 and complete abolition by 2020. The online payment service on the impotsgouvfr website is available around the clock. The 2019 budget includes tax simplification efforts to eliminate about 20 small taxes and recently President Macron has proposed to reform the so-called exit tax.

The government is in the process of lowering the French corporate tax rate from 333 to 25 percent by 2022. Personal income taxes in France can be complicated and difficult to calculate yourself. Exact tax amount may vary for different items.

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

An Overview Of The Taxation Of Residential Property Is It A Good Idea Public Sector Economics

Taxes In France A Complete Guide For Expats Expatica

Immovable Property Where Why And How Should It Be Taxed Suerf Policy Notes Suerf The European Money And Finance Forum

Property Taxes Property Tax Analysis Tax Foundation

Taxes In France A Complete Guide For Expats Expatica

Property Taxes Property Tax Analysis Tax Foundation

Feature Your Property At Europe S Premier Real Estate Event Exp Commercial Brokerage Real Estate Commercial Real Estate Real Estate Sales

French Taxes I Buy A Property In France What Taxes Should I Pay

Property Taxes Property Tax Analysis Tax Foundation

French Taxes I Buy A Property In France What Taxes Should I Pay

Taxes In France A Complete Guide For Expats Expatica

Will County Announces Property Tax Relief Measures For 2020 Estate Tax Property Tax County

Property Taxes Property Tax Analysis Tax Foundation

Immovable Property Where Why And How Should It Be Taxed Suerf Policy Notes Suerf The European Money And Finance Forum

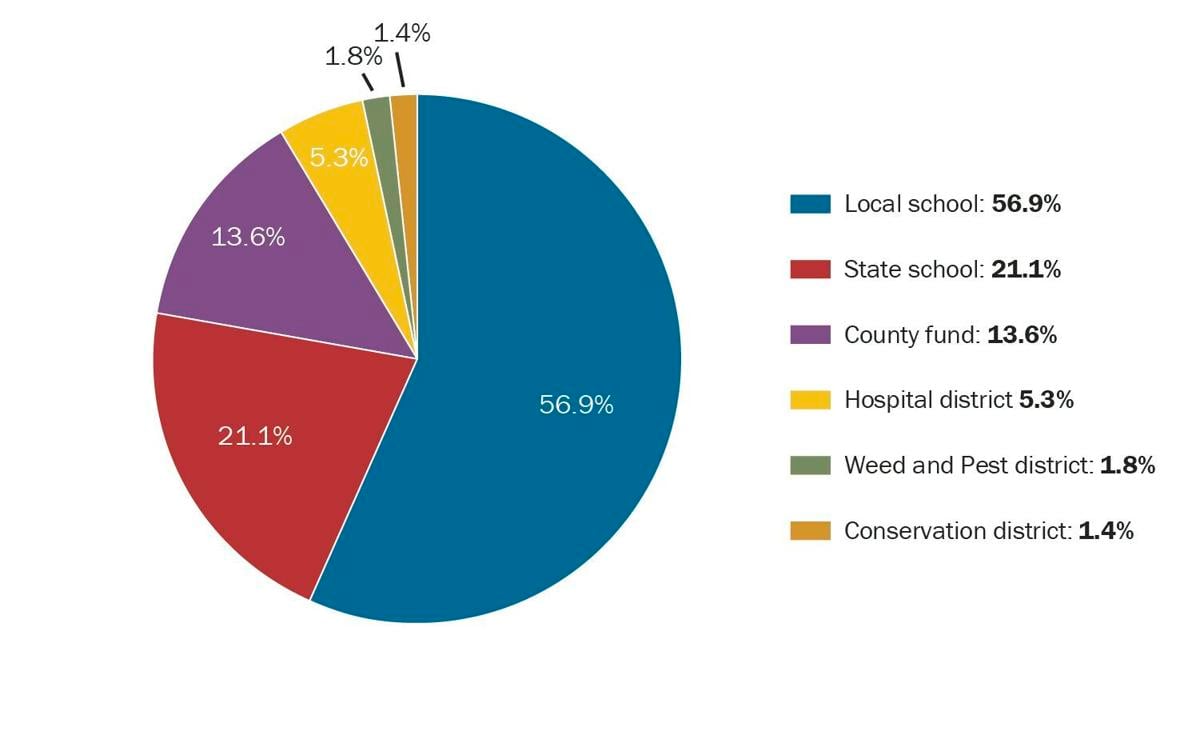

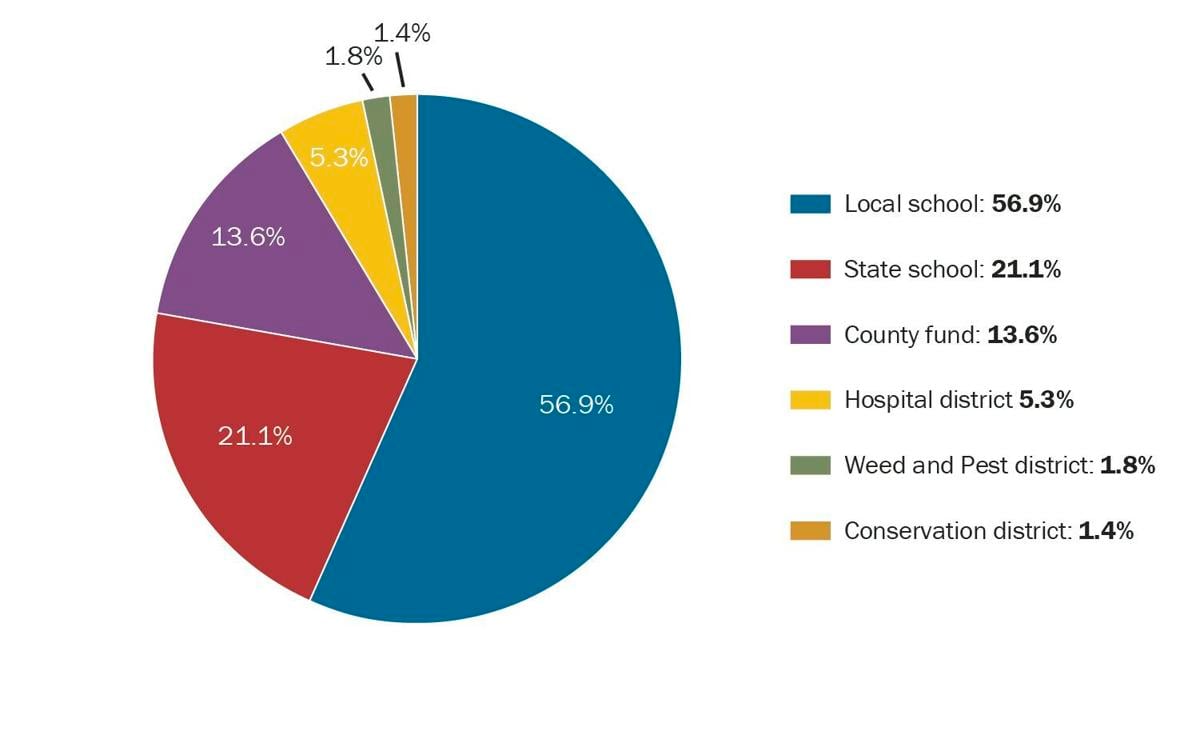

Property Taxes Could Soar 30 To 50 Business Jhnewsandguide Com

Estate Inheritance And Gift Taxes In Europe Laura Strashny

In Depth Guide To French Property Taxes For Non Residents Expats